The single biggest difference between financial success and failure is how you manage your money.

This seems like a no-brainer statement and it is – but yet every month people get easily trapped into the same cycle of “Spending without any thought” into what they are using their money and time on.

There is a great story that Jim Rohn (the legendary Motivational coach and speaker) used to teach that his mentor would say all you had to do was look at someone’s bank account to know what they valued in life, and in today’s fast paced world that is even more true.

Chances are if you have found my blog or Youtube channel, you know you want to be in control of your finances smarter – you want to use it to drive security and freedom in your life to create life on your terms without the stress and heartache that usually comes along with bad financial decisions. My hope today is that this method and principles will give you that freedom and growth that you have been looking for.

This method is called the “Money Stack Method” and is based on a method first mentioned by T. Harv Eker in his books “Secrets of the Millionaire Mind” and principles by such great motivational and wealth coaches as Jim Rohn and Tony Robbins, however I have taken it and adapted it slightly for what I feel works for my own family and for businesses.

DISCLAIMER – with any form of savings, this is your money and my advice is not exactly what you should do. You need to take personal responsibility for who/where/how you save or use your hard earned money every month, so don’t take my word for it.

Research every investment or savings/money management method you make so you are confident in your choices.

With any savings/investment there is a RISK you will gain and also lose money, so be fully aware of this and decide if it is something you wish to place your money into before doing so. This is your money and your responsibility.

Everything I mention on this blog I do with my own money for our family, but that does not guarantee you will receive the same results.

So WHAT EXACTLY is the “6 Money Stacks Method”?

If you have followed my blog for some time, I follow a 80/20 principle for life – that means that our budget is split as close as it can be for 80% of our monthly family budget used to live life right now and then 20% is in our future.

Our future is made up of Pension contributions, Investments (Passive incomes such as Stocks and Shares), Business ideas of our own (generating money outside of our day jobs) and then Education and Growth (learning new skills and mindsets).

In recent months though, I have seen actively the change that can come into our own life when we divide our budget more specifically and I want to share this with you today.

I am not apposed to other money management methods such as the Dave Ramsey Baby Steps for debt and wealth growth – however I feel these type of methods are missing a vital element.

That element is the Giving to others, that will allow us to use our money to do good bigger than ourselves each month, and also Personal Education and Growth.

This method involves setting portions of your money aside every budget cycle regardless of if you are in debt or not, as the goal is to manage money rather than “put off” good habits that allow you to turn money into a tool to better your life rather than Living to pay off bills.

In our family, we separate out each of the stacks into online individual banking accounts, one cash ISA and one Investment (Stocks and Shares) ISA BUT you can of course use cash envelopes or combine similar stacks as you feel you are able to track successfully. An example of combining stacks would be the “Essentials” in one account but then perhaps your “Fun Stack” and “Growth Stack” together to be used every month as you see fit.

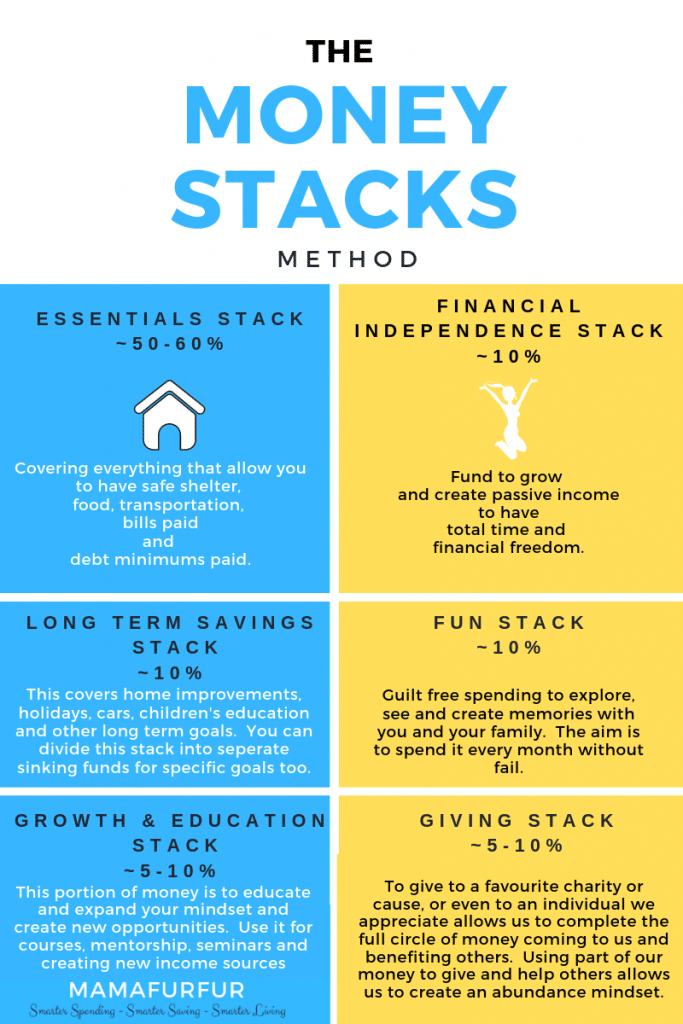

What are the 6 Stacks made up of?

- Stack 1 – The Essentials Stack (aiming for 50-60% of your budget but as low as possible) #EssentialStack

Essentials cover everything that allow you to have safe shelter, food, transportation, bills paid, debt minimums (plus 10% rule ideally, more explained about this in other debt videos on my blog and channel) and any other direct debits.

This shouldn’t include though Spoiling yourself or luxuries which falls under another stack described below.

This is purely keeping the lights on and a standard of living that is good and comfortable for you and your family.

Remember with all the stacks, we focus on percentage of your total income/budget rather than the amount you have.

As you earn more and time progresses, then obviously the Essentials Stack % number will decrease so do not be disheartened by your starting value.

This is a long term money strategy rather than an opportunity to judge yourself against others.

When you are looking to work out your percentage starting point, be sure to strip back any spending that doesn’t bring you joy in your life!

Get rid of that expensive Gym membership or magazine subscription if you believe you can use the money elsewhere with more joy!

Try other supermarkets and research the best deals if you feel like you are spending way too much on takeaways and food every month!

Do whatever you need to do to feel like your money is working for you and your life.

- Stack 2 – Financial Independence Stack (10% of your budget) #FIStack

My Personal goal for this blog and my youtube channel is to inspire others to create MORE MONEY from their money, regardless of their budget and create PASSIVE INCOMES.

Passive incomes means that we automatically receive money every month from our savings or investments (business or otherwise) that eventually we can choose to retire from our normal day job if we wish and live off the increase profits for the rest of our lives with security.

Financial Security and investments rely on the 8th wonder of the world (as Einstein would say) and that is the power of compound interest.

Your savings when invested in high interest bank accounts or investment/stocks and shares market will return you back part of their profits.

The value of your shares effectively go up or down comparing the day you purchased your stocks to that current day.

The key here is to spread your money over as many top performing companies as possible and then allow at least 5-10 years for consistant high growth to occur. This is NOT a get rich quick scheme, but a pot of money that you will live off the interest generated rather than the total amount you see.

This is a brand new concept to most people, but it is passive income generated every day for you with the goal that you can live off the money once it reaches your goal amount and more.

You could consider placing this stack within a Private Pension, allowing you access from age 55 years onwards, but ideally we would want some form of account we can access at any point in time when financial independence becomes possible.

I consider the Money Stack Method only for my “Post tax” money, and therefore my pension contributions currently are paid “pre-tax” from my employer’s wages and I don’t ever see the deductions. For this reason I only look at the money coming into my pocket to divide into the relevant stacks to spend and allocate.

- Stack 3 – Long Term Savings Stack (10% of your budget) #LTSStack

Within this portion of your money, we use it every month towards our bigger picture savings such as a new house, new car, holidays, home improvements, children’s university fees etc.

If you have debt in any way, I would strongly advise that you use most (if not all) of this fund to pay off the debt completely as quickly as you can.

My advice for anyone with any form of credit card or loan debt is always PAY THE MINIMUM then SOME! My 10% rule here is a true blessing to your money, and with this rule I say commit to at least the minimum amount required to pay the debt each month PLUS 10% EXTRA of the monthly amount at least.

I do this with our mortgage payment for example, and that small 10% extra a month added on allows us to pay our 25 year mortgage off within 22-23 years.

That gives us back a whole TWO to THREE YEARS owning our home from the bank completely outright!

This Stack can definitely be made up of various Sinking funds (smaller portions of savings for a specific purpose such as home improvements, holidays, christmas/birthdays) but collectively it is towards your longer saving goals with immediate access should you need it.

You can also include a smaller portion of this money to create a “New opportunity” sinking fund which I say is 3-6 months of living expenses to cover for anything that might require you to take time off from working, or potentially take up a new life/career should you wish to.

- Stack 4 – Fun Stack (10% of your budget) #FunStack

This Stack of money is your guilt free money that MUST be spent every month on luxuries that allow you to feel good about yourself and enjoy your money.

Rarely within money strategies we see an element allowed for being free and happy, and this is why I believe my Money Stack Method is critical to financial success.

Every month the goal is to spend this money on activities and outings where you enjoy the different luxuries and pleasures of life – think going to the cinema or a play; think getting your hair or nails looked after; think family days out with your loved ones.

Whatever you feel would allow you to enjoy your money and life, please use this money for it!

- Stack 5 – Growth and Education Stack (5-10% of your budget) #GrowthStack

Another critical money portion within my strategy is the Growth and Education stack which truly will change your life.

I believe when talking about money, people fair to mention that money is a tool to design our future rather than something to control our every day and thoughts with what we can “afford” to do or not do.

When we learn and discover new things, we grow and start to become the person we truly want to be.

This portion of your money truly will change your life – use it to attend Workshops in topics you are interested in or pick up the latest personal development book.

Use it to purchase online courses in whatever topics you fancy, or even use it to attend evening or weekend classes to become your ideal career profession.

You should also look at using this money stack to develop business ideas you can, creating other sources of income in the future, so that you move away from being an employee to a business owner in some part of your life.

This money really will allow you to expand and develop whatever is within you that wants to break free from your current standing and knowledge.

You don’t necessarily need to spend this money every month, but you could use it in a separate account and save up for a larger conference or educational event if you wish OR even for that next professional qualification.

Not to be limited to business related education too, it can be for anything where you want to learn and grow a new skill or mindset in your life to take it to the next level and even work towards your future goals.

- Stack 6 – Giving Stack (5-10% of your budget) #GivingStack

You will see in the fine print of this method that again the 80% of your budget breaks into living life right now with 20% of your budget on your Financial Independence and Growth/Education.

This stack is another one that will allow you to see money really can be a tool to help yourself whilst helping others.

Previously this type of giving would be called Tithing or Charity donations, and with the cycle of money flowing to us we know that we will also benefit when we give to others. We help improve someone else’s life because we are grateful for what we have already.

The final stack is critical to start this good habit of giving to others even if you wish to start as small as 1% of your budget and work upwards towards an amount you are comfortable with.

You could give to your favourite charity regularly, or make one off donations to whatever inspires you that month.

You could use it to give to your church or religious institute, or even give to someone else who has inspired you in some way in the past month.

This portion of your money really will take your money to the next level, in a similar way to the wealthy tend to give to others regularly to give back from where they have came from in some way.

It can be difficult to start this habit of giving to others, especially when money is tight at the start of any financial change of journey – but even with a simple £1 to something you feel passionate about to help will change your life. Imagine how wonderful it will feel when you see you are able to increase that donation over time to make a difference to others without a second thought in your spending habits.

The Money Stack Method centres on Investing in yourself, your future and life design

A whole portion of your money each month (10% of your Budget) involves INVESTING – Isn’t Investing scary?

Not at all, it is like any subject once you learn the basics then you can go ahead and do something rather than nothing.

I believe passive income (in the stock market in some way) Investments are for everyone, and there is a reason why the richest people in the world invest in companies and the stock market. It is because you are lending your money for a short or long term to another company to go make profits with. You are backing their idea and like most people in the world, their aim is to be successful so they don’t want you to lose your money.

With investments though, as we are dealing with real life companies using your money – then of course, you can lose money. But in life, everything comes with a potential to lose but my passion is to help you know enough to generate a solid strategy that doesn’t rely on your knowing the insider trading details that most believe stops them from taking any risk at all.

Here are a few of my Youtube channel videos with the basics of Investing and the Stock Market that I think you will enjoy:

If you have a pension through your workplace or privately, you are already an investor and probably don’t even realise it!

Your money placed into any pension scheme is being given to other companies to return a profit with in many years time, with that profit return then given back to you in part as a “regular income” every month.

With pensions though, you find there is a large amount of high charges included given that they have to guarantee you a set amount every month and need to ensure the amount they return back to you can be consistent even when the market might not be.

For this reason, I believe that a pension is VERY IMPORTANT as part of your financial strategy, but you should look to include other ways to get access to the same “income generating potential” before retirement age.

That is where an Investment ISA comes in, where you can invest tax free and use the power of the Stocks and Shares market with compound interest over time.

Do you think you could try the 6 Money Stack Method yourself and see a difference?

Having been on the painful debt repayment journey with my own family in recent years, I know that the money management systems out there are good but felt they were missing a few key elements that really would have helped people.

That is why I took the basics of some of the best strategies out there and blended them to give my own version called the Money Stack Method and this is what I use with my own family now.

Remember with any new strategy you wish to try, I recommend starting a fresh with a new budget approach (based on your past three months spending patterns) first of all and then seeing what percentages feel right for you for each of the Stacks.

If you can only manage 1% for each of the 5 Stacks outside of your Essentials Stack (all your bills and living costs currently), then START THERE but set a goal to increase it as often as you can.

When you get a pay rise, simply work on the ideal of 50-60% to Essentials, 10% each to the rest of the stacks and that extra money will take on the new ideal habit you wish from the start without any loss to your current living standard.

Every time you get a bonus – do the same and use the ideal percentages you wish!

I really hope this method will give a lot of positive ripple effects into your life as a whole, and believe that with it you will be on a fantastic financial journey for many years ahead with balance and fun.

Not enough money left over each month or barely enough to last you post the few few weeks?

With my Tried and Tested Principles, we can change your financial life around completely in just 1 week.

One thought on “My “Money Stacks Method” for building wealth”

Wow Wow Wow, I’ve watched the Youtube and read the blog post. Within 2 hours, this has become a complete game changer and realising that my head has been stuck in the hand all this time.

I’ve been using zero based budgeting for the past 6 months and made some progress, but not as much as I like. Using the Money Stack method and tying it in with Zero Based Budgeting has made something rather unique and has supercharged the control my partner and I have with our money.

Jennifer is a true money whizz and is providing this information to the masses to utilise. From debt to debt free!