Investment ISAs (Individual Savings Accounts) seem to be the buzz word right now in personal banking. Everyone and any bank and financial company is doing their best to get you to give them your money into one!

You might even have had a few leaflets through the door from various companies offering you fantastic rates of return, much higher than the normal savings rates, if you are willing to place your money in an Investment ISA for a minimum of five years.

I believe that everyone should make use of the personal option for a Cash ISA AND an Investment (Stocks and Shares) ISA if you are over the age of 18 years in the UK. I believe it is a KEY part of any financial security and freedom strategy that allows everyone to create passive income for their future, outside of their pension contributions.

DISCLAIMER – with any form of savings, this is your money and my advice is not exactly what you should do. You need to take personal responsibility for who/where/how you save your hard earned money every month, so don’t take my word for it. Research every investment or savings you make so you are confident in your choices. With any savings/investment there is a RISK you will gain and also lose money, so be fully aware of this and decide if it is something you wish to place your money into before doing so. This is your money and your responsibility. Everything I mention on this blog I do with my own money for our family, but that does not guarantee you will receive the same results.

So WHAT EXACTLY is an Investment ISA and why should everyone have one in my opinion?

- This type of savings account is TAX FREE on what you deposit and withdraw.

- The UK Goverment allow each adult to place up to £20k per year per person into a Cash and Investment ISA in their name, compared to normal savings accounts which are taxed. This means once you have earned your money, anything you place in an ISA will not receive tax on top of the interest you make over time.

- No Capital Gains Tax. You don’t have to pay Capital Gains Tax (CGT) on your ISA investments, no matter how much the investment grows in the future or how much you take out.

- This is a huge advantage over other forms of passive income such as Property investments, a side business or money received as dividends/normal stocks and shares.

- No Income Tax on what you withdraw – you are not taxed to take out money from savings within an Investment ISA.

- Completely amazing considering you are using the same Stocks and Shares market

- There are risks involved – your money is being used to buy individual parts of various companies, and like any company there is a risk you could lose your money. However I believe that if you pick smart to spread your money over as many top-performing companies as you can, you reduce the risk as much as possible and use a similar strategy as your pension.

- You don’t have to mention ISAs on your tax return.

- As this is part of your savings and you will make interest that could allow you to live off the amount as a income source (if the amount is large enough and I will show you the calculations how), you do not need to mention it exclusively on a tax return.

What is a Stocks and Shares ISA?

You might have heard the term Stocks and Shares ISA as well and been completely confused – this is actually the exact same as a “Investment ISA” so do not be put off by the name.

If anything this term best describes out of the two, “Investment ISA” and “Stocks & Shares ISA”, where your money will be held. You are buying stocks and shares in various companies with your money rather than allowing the bank to store it for you.

As we are buying stocks and shares with our money in an Investment ISA, you need to be aware that you will not have INSTANT ACCESS to your money. To get the money out of the account, you will need to request the Investment company to SELL the equivalent amount of shares for you to release the funds back to your bank account.

For example, if you wanted to sell £500 worth of your shares one day, then it can take up to 3-5 business days for the transaction to be completed by the investment company at the next available Stock trading time – and there is also a risk the pricing of the stocks will have gone up or down.

For this reason, my advice is when you save into your Investment ISA we view this money as “Income generating” exclusively with the goal ideally NEVER to withdraw the full amount out if we can avoid it.

Our goal is to withdraw the interest generated after a few years from it and moving forwards, but obviously if life happens that you need to withdraw the partial or full amount of savings – be aware of the time lag to receiving your funds back.

Isn’t Investing scary?

Not at all, it is like any subject once you learn the basics then you can go ahead and do something rather than nothing.

I believe Investments are for everyone, and there is a reason why the richest people in the world invest in companies and the stock market. It is because you are lending your money for a short or long term to another company to go make profits with. You are backing their idea and like most people in the world, their aim is to be successful so they don’t want you to lose your money.

With investments though, as we are dealing with real life companies using your money – then of course, you can lose money. But in life, everything comes with a potential to lose but my passion is to help you know enough to generate a solid strategy that doesn’t rely on your knowing the insider trading details that most believe stops them from taking any risk at all.

Here are a few of my Youtube channel videos with the basics of Investing and the Stock Market that I think you will enjoy:

If you have a pension through your workplace or privately, you are already an investor and probably don’t even realise it!

Your money placed into any pension scheme is being given to other companies to return a profit with in many years time, with that profit return then given back to you in part as a “regular income” every month.

With pensions though, you find there is a large amount of high charges included given that they have to guarantee you a set amount every month and need to ensure the amount they return back to you can be consistent even when the market might not be.

For this reason, I believe that a pension is VERY IMPORTANT as part of your financial strategy, but you should look to include other ways to get access to the same “income generating potential” before retirement age.

That is where an Investment ISA comes in, where you can invest tax free and use the power of the Stocks and Shares market with compound interest over time.

This is not a Sponsored post – I personally use Vanguard Investments for our Investment ISAs

Shopping around most banks will offer you an Investment ISA as part of their service, however in the past when I have used bank versions of this account the yearly charges and fund selection available for your deposited money is poor.

For my money, although I only purchase a few specific funds every single month as they suit our risk threshold (I am fairly risk positive for maximum returns) and financial goals (10+yrs for the income to start to generate) I want to know that I have a wide selection of funds to choose from.

Your money ideally should be with this company for minimum of 10 years to see a good rate of return on the investment, and looking around Vanguard are regarded as one of the world’s strongest investment companies with over $5.1 trillion in managed assets from its customers in the past nearly 50 years.

We need to see any Investment account differently from a normal savings account – there is NO GUARANTEED INTEREST RATE PER YEAR AUTOMATICALLY.

Every day your investments will go UP or DOWN against the stock value you paid the day you bought the stocks, so you need to get out of the mindframe of “checking up” on your stocks and letting emotions rule your decisions.

This account is to build up with money set aside to live off the interest profits in many years to come, in a similar way as your pension pot will be when you retire, so looking at the amount invested or the change in stock value daily or weekly will not do yourself any favours mentally.

Vanguard is essentially a non–profit, because it is owned by the investors in its funds. Therefore any profits it earns are returned to the investors in its fund in the form of lower fees (you will find their fees are the lowest generally in the UK and USA) but of course it is the performance of the fund we should pay attention to as well as any charges.

From my extensive reading about investments in the UK, this is the company I recommend and use personally. With an Investment ISA though, you have the option at any time to transfer your funds to another company for another Investment ISA or cash out your investments completely.

The power is in your hands, and with Vanguard being one of the longest standing and popular selections for Investments ISAs and Investments generally, I am secure in knowing that my money is safe as it can be with them.

Again, I would say do your own research into any company you use and charges, this is your money and you are responsibility for your financial decisions only.

How do I go about setting up an Investment ISA account?

It really is as simple as opening any bank account.

First of all go to https://www.vanguardinvestor.co.uk/

To start you would select the Vanguard ISA option, with your National Insurance number and a current active bank account (for your regular monthly deposit to be taken from OR where you would like a lump sum to come from to open your account).

You will then follow the step by step process on screen to input all your personal details, and create the electronic paperwork to open the account.

With Vanguard, you have two options when opening – you will make a regular deposit of £100 a month at least to the account of certain funds purchased automatically OR you can deposit a lump sum of £500. Remember with ANY ISA the limit you can deposit every tax year is £20k per person currently. If you are a couple though, you can have one in each name which opens up a huge amount of savings potential.

The choice is yours, but personally I use the monthly amount so that we use it as part of our money management family strategy.

Any time we wish to top up the ISA with further funds, I then do this as we see fit.

How do you pick a fund?

Understanding the many hundreds of passive, active, EFT and individual shares you can buy using your money can seem very daunting.

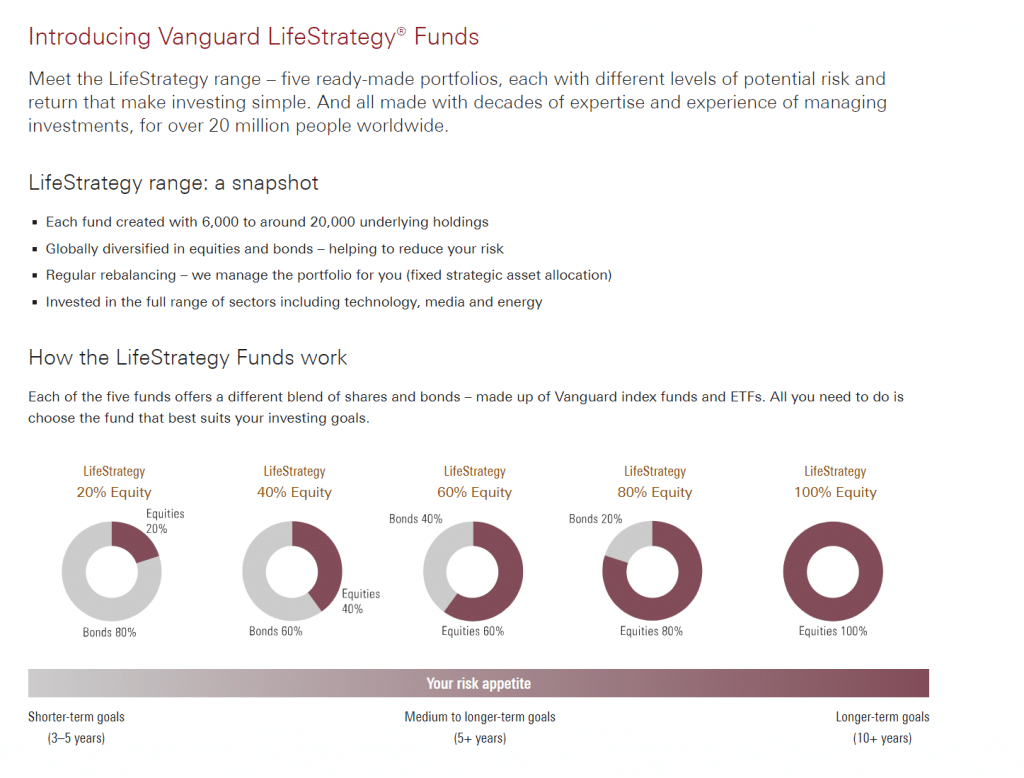

I love that Vanguard give the option for a few ready-made mutual funds (these are a collection of many hundreds of companies stocks and shares to spread your risk with diversification) and personally my family use the Lifestrategy 100 fund as we aim to use the money within 10 years or more.

I would say unless you plan to retire within the next 5 years, that this fund would give you a good spread of your money – this or the Lifestrategy 80 fund is a good solid choice for most people at the start of any financial journey before the age of 50 years.

This information below from their website is perfect for understanding the basics you need to know, and if you are struggling with the terms used please refer to my videos mentioned above again:

The old rule of thumb used to be that you should subtract your age from 100 – and that’s the percentage of your portfolio that you should keep in stocks.

For example, if you’re 30, you should keep 70% of your portfolio in stocks.

I say though we have to look at your financial goals rather than your age to get a good feel of what suits your life.

An Investment ISA as part of a bigger picture – Your financial security and freedom

I feel so passionately about investing as I know that the proof is there that the concepts work to give you a passive income once you get past the initial “scared” factor of the term investing.

Investing in yourself, a business idea and other businesses allows you to think differently about money and how you use it.

It allows you to use your money to generate more money – seeing it as a tool for your security and future rather than an item to have control over you.

I use Investing as part of my 80/20 Strategy with our family’s savings and money and every month without fail we invest.

I will be sharing more on this blog about my specific “Six Jar System” that I have recently found has changed our money mindset completely, and one that I believe will help alot of people create abundance and wealth rather than stress with money.

Not enough money left over each month or barely enough to last you post the few few weeks?

With my Tried and Tested Principles, we can change your financial life around completely in just 1 week.

One thought on “Investment ISA – Opening an account with Vanguard”

Great tips and an interesting read x