Credit scores can seem like a dirty word especially when you are trying to get that first mortgage or apply for credit to start your next life project.

It is definitely important to take time to understand how your credit rating number and report are made up, and how you can influence it for the better.

Whether we like it or not, the information stored about our credit dependability and past history is used not only for mortgage requests, loans, credit cards but also every time we look to take out a new contract in some way such as for our mobile phones or car insurance.

But do we really know what makes up our score, and MORE IMPORTANT how we can improve it over time?

DISCLAIMER – with any form of savings or advice on this blog/Youtube channel, this is your money and my advice is not exactly what you should do. You need to take personal responsibility for who/where/how you save or use your hard earned money every month, so don’t take my word for it.

Research every investment or savings/money management method you make so you are confident in your choices.

With any savings/investment there is a RISK you will gain and also lose money, so be fully aware of this and decide if it is something you wish to place your money into before doing so. This is your money and your responsibility.

Everything I mention on this blog I do with my own money for our family, but that does not guarantee you will receive the same results.

What is a Credit Score and how is it calculated?

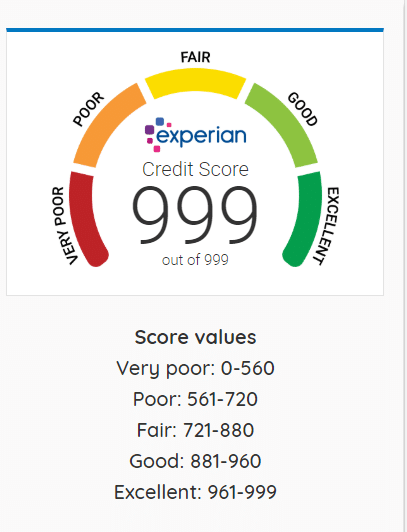

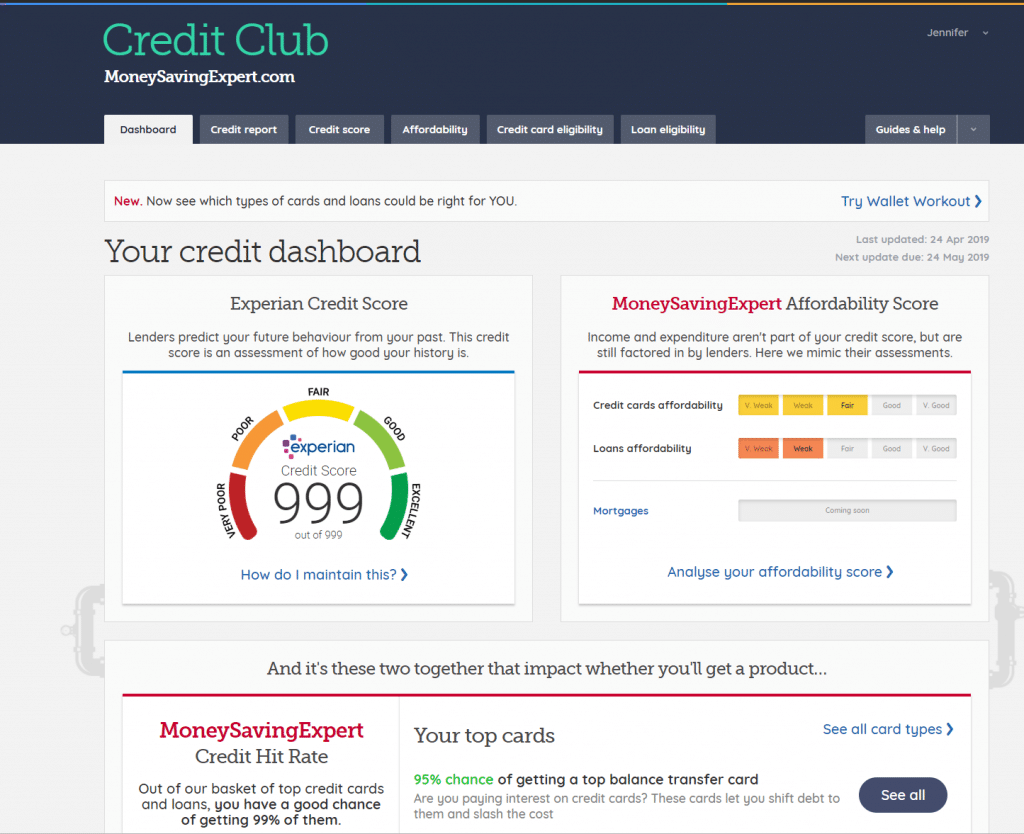

Your credit score is a number between 0 and 999 that represents how you have handled credit in the past and your likely behaviour in the future. Lenders predict your future paying ability from how you have manage credit in the past, right down to any missed payments or any serious money issues such as CCJ or bankruptcy.

It is based on your credit report which is a detailed listing of your credit history, and compiled by one of the UK’s three specially licensed credit reference agencies; Equifax, Callcredit and Experian.

It contains detail about how much credit you have borrowed in the past, how you handled the payments and how much money you have still due; if there was any fraud attempts with your details made in recent years; and also contains personal information such as your home address, electoral status, employment status and some other details.

The report is updated once a month generally, and information held for up to 6 years and after that time it will be removed.

With this information about past borrowing of credit being stored centrally, it means that any lender can access the information freely about your potential credit behaviour and make a decision on whether to allow you to have their product and for what length of time/interest rate for that time period.

Any company cannot just check this report when they wish, they must have your permission to do so and is part of a credit application process.

Your credit Score number (out of 999) will determine ultimately the application success rate and interest rate you will be offered if you have a successful credit application.

The lower your score, the less likely of being approved BUT also the higher the likely charged interest rates.

If you have a score termed as Good or Excellent – above 881 to 999 – you will usually have access then to the cheapest interest rates and terms available at the time which is particularly crucial if you are seeking to gain a new mortgage or enter a new agreement.

If you are gaining a score which is termed “Poor” or “Fair” – between 561 to 880 – then likely you will be paying higher interest rates and the choice of lenders will be dramatically reduced.

Unfortunately, with bad credit history through choices in the past or lack of credit history at all, you are likely to find that your choices are credit will not be approved until we can do something to dramatically change our credit report and history starting today onwards.

What searches are completed on your report?

The report will list details of how many “hard” and “soft” searches have been carried out recently in the past 6-12 months.

When a lender checks your report, this is called a “hard search” where the application for more credit has been confirmed. This could be for a credit card or mortgage set up for example, where we are actively looking to borrow more credit against our name.

A hard search can affect your credit score by lowering it, as if you have a few hard checks carried out within a short space of time it can appear that you are desperate for credit suddenly and struggling financially. For a potential lender, this could mean that you have changed circumstances and potentially will not be as reliable in the future as your score and report suggest.

This could be a sudden job loss or redundancy for example, where a person is looking for more credit to balance life until they regain employment.

The best advice would be for any hard searches that you know you need to make against your report, that we try to limit them to as small a number as possible at the same time period to avoid looking like we are needing extra credit suddenly without a plan for its use.

A “soft” search is where your rating and report is checked but won’t affect your credit score.

Examples of this would be when we sign up for a monthly payment for our car insurance, the company will do a soft check to make sure you are not struggling financially and can make the payments by past history with other companies but you are not looking for more credit.

How can you access your credit score and report?

It is worth noting that your credit score should not be treated as a hard and fast rule to confirm if you will be approved for credit cards or a new mortgage – some lenders look for other criteria before lending such as asking for your monthly budget breakdown and likely planned spending ahead – so we must treat the number as more an indicator of what we can expect from applications.

Whilst researching this topic, I came across MoneySavingExpert’s Credit Club and signed up for it FREE of charge where they provide you with your credit score and report updated once a month.

I found it a fantastic tool to search though, including a detailed credit report in my name so I could check for any errors really easily.

How can you improve your score and report in a short space of time?

It is strongly advised to check your credit score and report at least every few months where possible, mainly to ensure it is completely accurate.

It is your responsibility in that area as this is centrally stored information and could affect our life choices with credit in the future.

If we believe information is incorrect on the report, then we do have a right to contact the company involved (for example with a late payment) and have either the error removed completed OR ask that a note be added to the report to give more detail (such as you were unemployed for a short period of time for example).

Here are some of the ways you can improve your credit rating in a short space of time:

- Check your credit report regularly for any errors and FIX THEM – if you have any missed payments showing, use your rights to contact the lender and ask that it is removed if an error or with detail added about the reason why the payment was missed. For example, it could be wrong bank account details were used and you sorted it the next day with the lender. By having that level of detail added could change the outcome of your applications in future months.

- Sign up to the Electoral Register with your current home address and details. Such a simple small detail but this shows that you are a UK resident and have a current permanent residence.

- Check who is linked to your Credit report and UPDATE – make sure that any joint bank accounts no longer in use are updated to your name only, and be aware that any time you have a joint credit application with someone else you will then share their credit history on your report and file too.

- A credit card CAN HELP improve your score, but only if you use it with care. If you are able to get a credit card to show you can manage it carefully and committed to monthly payments, the sole aim and purpose should be to pay the card off fully every month or aim to pay off more than the minimum payments. Getting a credit card should be part of a successful money management strategy rather than an everyday item.

If you are struggling with credit card debt currently, you might find one of my latest videos helpful to paying it off as quickly as you can:

- Commit to NEVER MISSING a due payment on any direct debit or bill you have due – that means ensuring your bank details are up to date with companies such as utilities, car insurance, TV company etc and if you change or update your bank account ensure every company is contacted before the next due bill cycle to ensure that no “missed payments” show on your report for up to 6 years.

- NEVER WITHDRAW CASH from a credit card – first of all, the fees will be horrible for you but also it shows to the lender that you are in desperate need for money to make ends met. We want to ensure that our credit is used with a healthy attitude that it is always paid off in full and outside of our normal spending patterns.

- AVOID PAY DAY LOANS completely! This goes without saying but avoid any kind of “short term” fixes of loans at all costs for the sake of your credit report. These type of credit lenders offer the worst interest rates when people are struggling, many future lenders will not consider your application if they see a Pay Day loan successful application on your report. Avoid at all costs!

- CLOSE DOWN ANY UNUSED ACCOUNTS – having too many credit cards with unused credit can also affect your report and rating. Check your credit report and close down any unused credit cards, store cards or accounts as a top priority. This will show that the credit you have is being actively managed rather than access to alot of unused credit without any purpose.

- Keep your credit card usage below 75% ideally – if we appear to be consistently using most of our credit available every month, or have reached our limits on our current credit cards, then future lenders will view this as poor money management and be reluctant to give us more.

For larger life goals such as a mortgage, the ideal would be to save up as much of a deposit as possible before making your application to lenders.

In this video I talk you through some of the options for those considering a new home that might be useful to you:

Not enough money left over each month or barely enough to last you post the few few weeks?

With my Tried and Tested Principles, we can change your financial life around completely in just 1 week.