Welcome to our monthly “Share it All” Family Household Spending and Saving Report (A REAL FAMILY BUDGET YOU CAN COPY THAT WORKS TOO!).

Welcome to our monthly “Share it All” Family Household Spending and Saving Report (A REAL FAMILY BUDGET YOU CAN COPY THAT WORKS TOO!).

My mission for this blog is help others work towards financial and time freedom, and that means putting your money to smarter spending, smarter saving and then making sure you do some smarter living along with it.

So below you will find the exact tools and strategies I use with my family’s incomes for doing just that and our progress towards our ultimate goals.

Feel free to copy and use these for your own family, and I would love if you would like to share your budgets to compare using the hashtag #realfamilybudget too.

We budget to Zero with our Spending Report

I rename our Household Budget our “Spending Report” as how we use language in our descriptions of anything can affect the emotions that it brings within us.

We all are very fortunate to have homes and food to eat, better than 99% of the world, and when we focus on using our money to send it different places for our benefit that is when we feel positive about what we are creating.

I’m a huge believer in the Law of Attraction and believe that when we have a purpose to our spending, which is what a Budget really is, then this will allow more opportunities to come to us for showing more attention to where the money goes to.

In my Spending report, I use every last penny each month sending it to a specific fund or place – such as Investments/Savings, our retirement money and then how we spend it with our family and fun time.

I like to sit down at the start of every month and roughly plan how we will use the money in each allocation – such as family fun money – so that we can really plan how we will use it and use it well.

Our Long term Goals

I take what I say and preach on this blog about creating a life of financial freedom and security, to create the balance of time and lifestyle of your dreams, very seriously.

Our family are working towards that very goal, and we are on target to hit it within the next 10 years, to retire early and live off our side businesses and investment increases.

In fact, with the power of compound interest and extra hard work than normal – it might be even sooner than that!

Our family knows the exact amount of money in Investments we need to reach in order to live off the interest payments indefinitely, and it isn’t rocket science.

You can calculate your value as your goal too here.

For any financial goal, whether it be to pay off debt like we have (we paid off £22k of credit card debt in the past few years alone with these strategies learnt) once you have the exact amount to work towards it will start to become reality as you take action towards it.

Want to know how to create your own Spending Report?

Check out one of my latest videos that explains how to start creating Spending Reports/Budgets so you can work towards goals such as retiring early, paying off that debt and creating your dream life and much more.

Our 2018 Money Goals

We have a few buckets of money goals this year ahead, to keep us on track to hit our financial freedom long term goal but also so that we can live life comfortable and plan for the future.

This includes saving each month towards a bucket of money for Christmas and Home improvements, Insurance bills etc.

Next we have a large goal towards Invested money for 2018, which is a stretch on our normal comfortable saving pattern on Autopilot.

Then we are planning on holidays throughout the year and next, so we have a budget goal for that account.

Finally, we have created a 6 month Emergency Money account.

This means if we lose our regular incomes we would have 6 month’s worth of money saved to cover all the essential bills and food & petrol.

It’s then our job to recover those incomes within that time.

I should say that if you follow my Budget planning video, you will know that we apply a 10% additional payment to our Mortgage and Car payments, so that we will pay those off earlier than forecasted but also it allows a buffer if we needed to remortgage to a lower monthly amount if we were unemployed for any reason – and not lose our home!

You can find a few posts in particular about our Budget Style – I call it the 80/20 Budget – here.

Our December Budget

Start of the month, our main savings amounts go straight out on autopilot standing orders to our budgets so that we save without even questioning it.

We pay our future selves first, then use the rest to have fun and live life.

This means even our investments are calculated and paid at the start of the month, so that we are not tempted to spend that money first.

Our Food & Petrol money account and our Family Fun money is then our free money to manage the rest of the month as we see fit.

The goal is to spend it on things that bring us joy, and it isn’t a challenge to make sure we have some left over.

Any left over from these money accounts though at the end of the month is usually transferred to our Emergency Goal account or Invested.

Then we start over the next month on a zero budget afresh.

If you want to learn more about the Electronic Cash Envelope System I use each month, working with a Zero Budget system, please check out this post here.

How did we do this month?

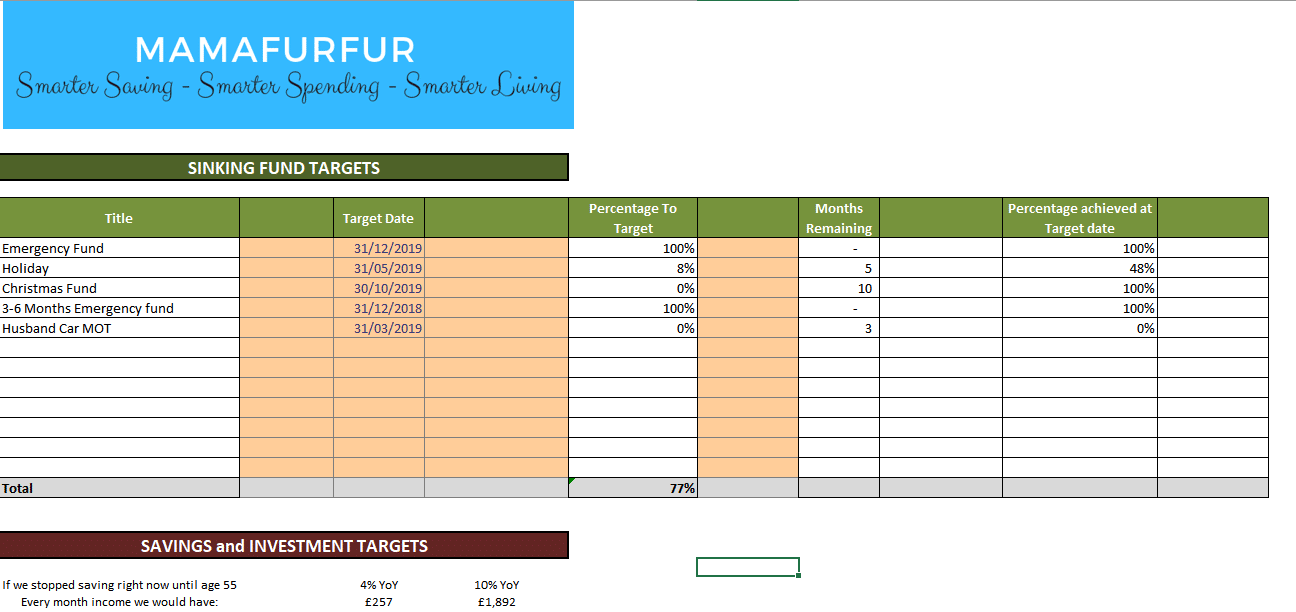

Here is the screenshot of how much we saved over from our cash budget accounts, and how we are doing to targets for end of 2018 financial goals.

You can also see how we are doing to our overall Financial Freedom target.

I’ve also added in some extra data to my spreadsheet – How much money we are generating with our investments for the future.

You can see that by using rough estimates of return of investments percentages of 4% and 10%, by tracking the age that we can be financially free is inspiring.

I’ve also listed how much monthly money I have added to our family’s “retirement” budget if we SAVED NOTHING MORE and let that amount sit there and generate interest until I was 55.

The month those amounts for our “predicted” (as nothing is guaranteed in stocks and investments) monthly increase amounts if we stopped paying into our investments took a jump up which was exciting to see.

// How are doing towards our 2018 Goals?

December is always the classic month that people struggle, but as we had planned and saved all year our Christmas was completely paid for in cash ahead of time.

We even had travel planned for and saved for to allow us to see our extended family in London (some 600 mile round trip from Glasgow) with money allocated for activities down there too.

The secret really to any event coming up and planned for is to make your budget and regular savings for it a real amount you can use and enjoy.

Breaking it down into smaller chunks each month makes sure you do not go into debt for one day.

We even had a few Zero Spend Days within the month as always.

If you have never heard of Zero spending days, please be sure to check out my post and video here – you will love it!

We focus on investing in our spending also on long term leaving our money there, it is not a short term solution – invest in index linked funds, and forget about it for a good few years before considering selling out.

The shares only have value when you cash them out – so don’t get the fear and take it out when it is dropping, wait till you need it properly.

It is really exciting to see that our investment target will be smashed if we carry on the way we are with saving this year, and that it is generating extra money for our retirement and even potentially allowing us to retire early in a few years time mid-40s.

The power of money and compound interest is a wonderful thing!

What went well and what can we do differently next month?

December felt no different from any other month, although in some ways as we had preplanned activities and budgeting for them ahead of time in our Christmas fund – the days didn’t seem to add up with costs the way a normal month would have.

During Christmas we also had annual leave and holiday together as a family, which was wonderful to be together over the holidays without work and school.

My only concern would be that I would have like to have put more towards our investments since we did so well with our planning this year, but sometimes life gets in the way with car expenses and other items that you cannot plan for.

Remember to always make sure you plan for your goals too, and you never know what will come your way!

Be sure to check out my Youtube channel to never miss an update video on our budget, and for advice and tips on how to set up your own budget that works.

[adinserter block=”1″]