Welcome to our monthly “Share it All” Family Household Spending and Saving Report (A REAL FAMILY BUDGET YOU CAN COPY THAT WORKS TOO!).

My mission for this blog is help others work towards financial and time freedom, and that means putting your money to smarter spending, smarter saving and then making sure you do some smarter living along with it.

So below you will find the exact tools and strategies I use with my family’s incomes for doing just that and our progress towards our ultimate goals.

Feel free to copy and use these for your own family, and I would love if you would like to share your budgets to compare using the hashtag #realfamilybudget too.

DISCLAIMER – all information given is not intended to act as financial advice for your unique situation.

Before changing any money strategy or investing, please ensure you are comfortable with all the costs and risks and ensure you are fully responsible for your actions. This is your money, and my family’s situation will be different to yours – so use your own judgement wisely.

Some links below are affiliate links, which means I receive a very small percentage of the profits if you purchase the items mentioned.

We budget to Zero with our Spending Report

I rename our Household Budget our “Spending Report” as how we use language in our descriptions of anything can affect the emotions that it brings within us.

We all are very fortunate to have homes and food to eat, better than 99% of the world, and when we focus on using our money to send it different places for our benefit that is when we feel positive about what we are creating.

I’m a huge believer in the Law of Attraction and believe that when we have a purpose to our spending, which is what a Budget really is, then this will allow more opportunities to come to us for showing more attention to where the money goes to.

In my Spending report, I use every last penny each month sending it to a specific fund or place – such as Investments/Savings, our retirement money and then how we spend it with our family and fun time.

I like to sit down at the start of every month and roughly plan how we will use the money in each allocation – such as family fun money – so that we can really plan how we will use it and use it well.

Our Long term Goals

I take what I say and preach on this blog about creating a life of financial freedom and security, to create the balance of time and lifestyle of your dreams, very seriously.

Our family are working towards that very goal, and we are on target to hit it within the next 10 years, to retire early and live off our side businesses and investment increases.

In fact, with the power of compound interest and extra hard work than normal – it might be even sooner than that!

Our family knows the exact amount of money in Investments we need to reach in order to live off the interest payments indefinitely, and it isn’t rocket science.

You can calculate your value as your goal too here.

For any financial goal, whether it be to pay off debt like we have (we paid off £22k of credit card debt in the past few years alone with these strategies learnt) once you have the exact amount to work towards it will start to become reality as you take action towards it.

Want to know how to create your own Spending Report?

Check out one of my latest videos that explains how to start creating Spending Reports/Budgets so you can work towards goals such as retiring early, paying off that debt and creating your dream life and much more.

Our 2019 Money Goals

We have a few buckets of money goals this year ahead, to keep us on track to hit our financial freedom long term goal but also so that we can live life comfortable and plan for the future.

This includes saving each month towards a bucket of money for Christmas and Home improvements, Insurance bills etc.

Then we are planning on holidays throughout the year and next, so we have a budget goal for that account.

Finally, we have an emergency account that is being created at the moment. This is an account with roughly 3-6 months of expenses so that if we wish to change any aspect of our lives, we can do so without the risk of running out of living costs.

It’s then our job to recover those incomes within that time.

I should say that if you follow my Budget planning video, you will know that we apply a 10% additional payment to our Mortgage and Car payments, so that we will pay those off earlier than forecasted but also it allows a buffer if we needed to remortgage to a lower monthly amount if we were unemployed for any reason – and not lose our home!

This year I’m also using a fantastic comparison tool, Idealo , to prepare us for Christmas expenses keeping our Sinking fund for that event as low as possible.

Idealo kindly wanted to sponsor this video to make sure that you know about them too – I love their Price Comparison Alert tool where you set the amount you wish to pay and then you receive an email straight to your inbox when a supplier has it on offer for that price. This will save my family and yours a serious amount of time and money this Christmas I’m sure!

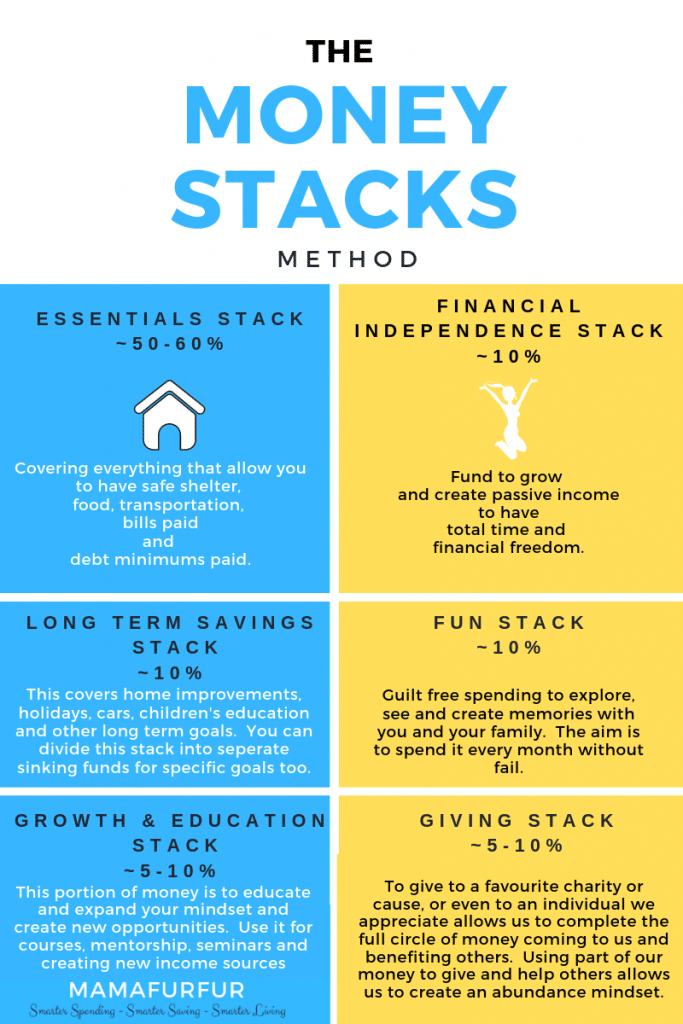

What budget style do I use? The Money Stacks Method

With so many different money strategies out there, I found it confusing and difficult to design life on our terms for the long term.

That is why I created a blend of the very best budgeting strategies out there and advice, and it is called the Money Stacks Method.

You can find my full blog post and video explaining this strategy here:

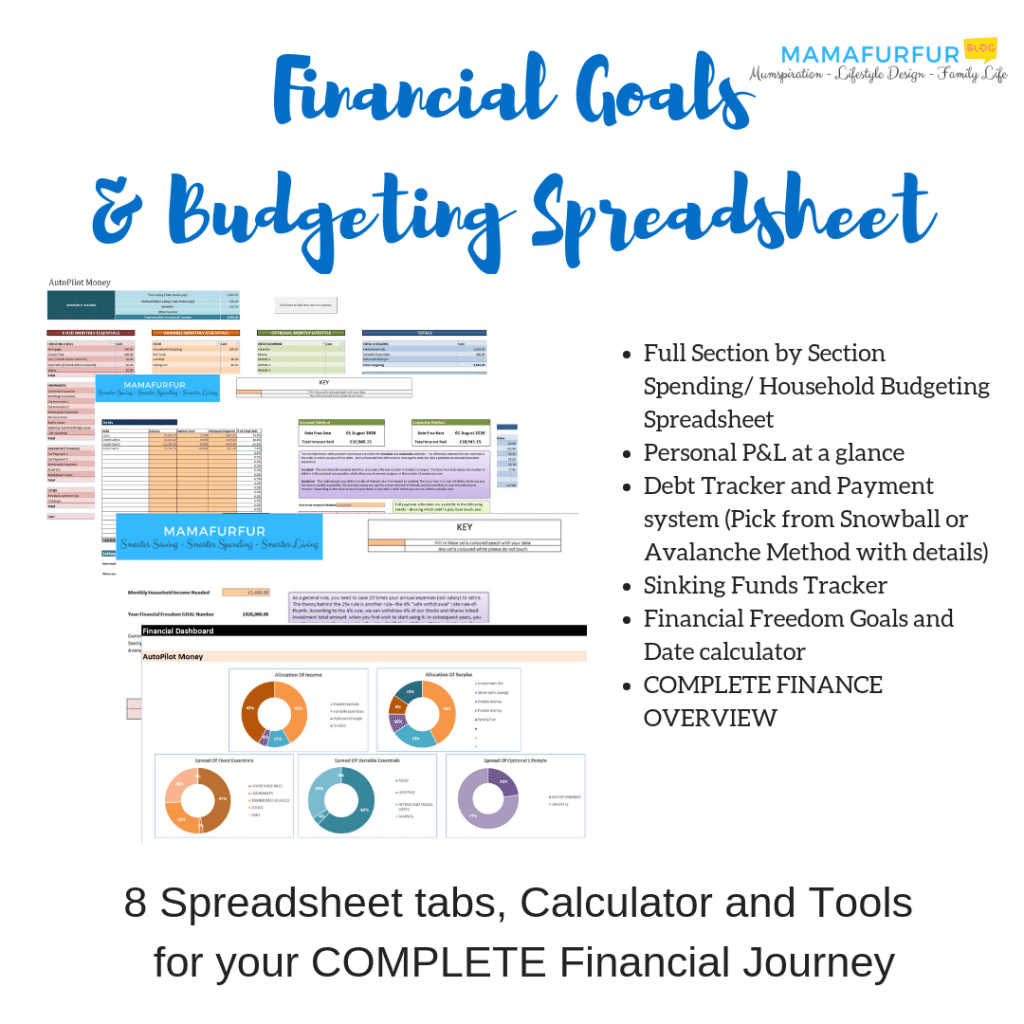

In this video you will see me use my electronic spreadsheets called the Autopilot Money System to track our Budget in detail, Savings percentages for our Money Stacks categories, our Net worth P&L and our Financial freedom retirement date calculation.

You can pick your own copy for your family here on my Etsy store:

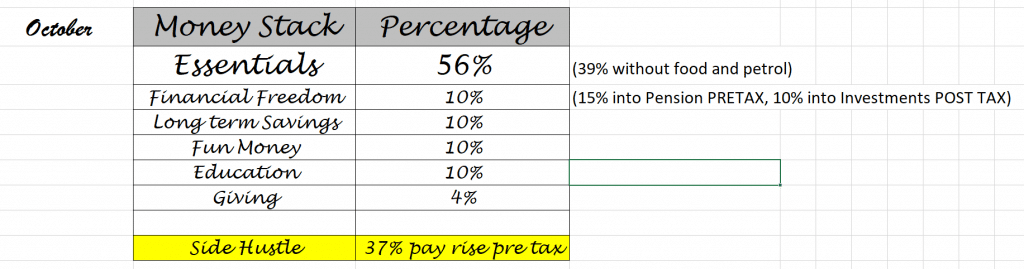

Our October 2019 Budget

Start of the month, our main savings amounts go straight out on autopilot standing orders to our budgets so that we save without even questioning it.

We pay our future selves first, investing in our financial freedom and retirement, then use the rest to have fun and live life.

This means even our investments are calculated and paid at the start of the month, so that we are not tempted to spend that money first.

Our Food & Petrol money account and our Family Fun money is then our free money to manage the rest of the month as we see fit.

The goal is to spend it on things that bring us joy, and it isn’t a challenge to make sure we have some left over.

Any left over from these money accounts though at the end of the month is usually transferred to our Emergency Goal account or Invested.

Then we start over the next month on a zero budget afresh.

How did we do this month?

Here is the screenshot of our Family money stats for October, and also our Money Stacks percentages currently.

The big difference for us this month was switching up and increasing some of the minor Money Stacks such as our Fun Money and trying to move them more towards 10% equally each. Our Giving will drop to 4% from last month as a result, but my hope is to drop our overall Essentials budget from 56% closer to 50% in the next month ahead.

That money then will allow us to make our Giving a full portion of our money too and I’m excited to achieve this.

You can catch the full video of my budgeting for the month ahead here:

If you have enjoyed this breakdown of our Budget, be sure to comment below how you budget and any financial goals you are working towards as an individual or family.

I always love to hear how you spend your money and on what matters most to you, and really having a plan allows for the flexibility whilst hitting those goals!

[adinserter block=”1″]