This is the first in a monthly series that I feel inspired to share with you all.

Welcome to our first Family Household Spending and Saving Report (A REAL FAMILY BUDGET YOU CAN COPY THAT WORKS TOO!).

My mission for this blog is help others work towards financial and time freedom, and that means putting your money to smarter spending, smarter saving and then making sure you do some smarter living along with it.

So below you will find the exact tools and strategies I use with my family’s incomes for doing just that and our progress towards our ultimate goals.

Feel free to copy and use these for your own family, and I would love if you would like to share your budgets to compare using the hashtag #realfamilybudget too.

// Our Long term Goals

I take what I say and preach on this blog about creating a life of financial freedom and security, to create the balance of time and lifestyle of your dreams, very seriously.

Our family are working towards that very goal, and we are on target to hit it within the next 10 years, to retire early and live off our side businesses and investment increases.

In fact, with the power of compound interest and extra hard work than normal – it might be even sooner than that!

Our family knows the exact amount of money in Investments we need to reach in order to live off the interest payments indefinitely, and it isn’t rocket science.

You can calculate your value as your goal too here.

For any financial goal, whether it be to pay off debt like we have (we paid off £22k of credit card debt in the past few years alone with these strategies learnt) once you have the exact amount to work towards it will start to become reality as you take action towards it.

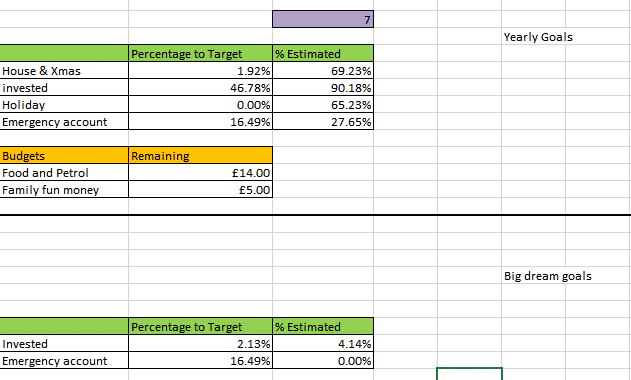

// Our 2018 Money Goals

We have a few buckets of money goals this year ahead, to keep us on track to hit our financial freedom long term goal but also so that we can live life comfortable and plan for the future.

This includes saving each month towards a bucket of money for Christmas and Home improvements, Insurance bills etc.

Next we have a large goal towards Invested money for 2018, which is a stretch on our normal comfortable saving pattern on Autopilot.

Then we are planning on holidays throughout the year and next, so we have a budget goal for that account.

Finally, we wish to create a 6 month Emergency Money account.

This means if we lose our regular incomes we would have 6 month’s worth of money saved to cover all the essential bills and food & petrol.

It’s then our job to recover those incomes within that time.

I should say that if you follow my Budget planning video, you will know that we apply a 10% additional payment to our Mortgage and Car payments, so that we will pay those off earlier than forecasted but also it allows a buffer if we needed to remortgage to a lower monthly amount if we were unemployed for any reason – and not lose our home!

// Our April Budget

Start of the month, our main savings amounts go straight out on autopilot standing orders to our budgets so that we save without even questioning it.

We pay our future selves first, then use the rest to have fun and live life.

This means even our investments are calculated and paid at the start of the month, so that we are not tempted to spend that money first.

Our Food & Petrol money account and our Family Fun money is then our free money to manage the rest of the month as we see fit.

The goal is to spend it on things that bring us joy, and it isn’t a challenge to make sure we have some left over.

Any left over from these money accounts though at the end of the month is usually transferred to our Emergency Goal account or Invested.

Then we start over the next month on a zero budget afresh.

If you want to learn more about the Electronic Cash Envelope System I use each month, working with a Zero Budget system, please check out this post here.

// How did we do this month?

Here is the screenshot of how much we saved over from our cash budget accounts, and how we are doing to targets for end of 2018 financial goals.

You can also see how we are doing to our overall Financial Freedom target.

// How are doing towards our 2018 Goals?

This month saw us move from PCP deals on two cars to buying them outright on finance, so that we eventually will own them which saw us again take any spare cash that would have been for household straight to pay for deposits and put as much as we could into finance to keep our payments down.

Our goal is within 3 years to have both cars paid off fully, which is a strict plan, but we are confident we will achieve it.

We financed two cars with a combination of a loan from the bank (very cheap interest of around 3%) and the second car with a credit card on 0% interest for 30 months.

Another large expense that our household budget took this month was my car insurance needed to be paid up for the year ahead, and rather than pay monthly we decided to pay the full year upfront to save costs.

We actually even ended up using a TopCashBack deal to gain £75 cash back on my insurance, making it not only the cheapest insurance deal I could find – but a great one!

This month will see up finish up clothes shopping for our holiday in June time, and particularly the children will need a refresh of clothes for the summer months.

We ended up though with a few pounds spare in our food money which will be saved towards that expense in June, so although it was an expensive month relatively, all expenses are actually putting us in a better financial position to financial freedom.

// What went well and what can we do differently next month?

This month we had a lot of expenses, but with our system it meant we were prepared and able to cover the full amounts without anything putting us into debt.

We also increased our additional contributions to our mortgage in prep for the builder buy-out this month, so it is lovely to see we coped fineand able to still enjoy life as a family.

Be sure to check out my Youtube channel to never miss an update video on our budget, and for advice and tips on how to set up your own budget that works.

One thought on “April 2018 Family Household Spending & Saving Update ¦ Real Family Budget Report”

I am so following this. Thanks for sharing x