Investing in your future with our time and our money is one of the most fundamental skills we can learn as we progress in life.

Often people are concerned with the term “investing” and feel too overwhelmed with what it could involve and the potential risks/wins of investing – but I’m here to teach you that absolutely ANYONE CAN and should invest, particularly using tax free options such as Investment ISA (Individual Savings Accounts).

In this post I share with you some of the key basic terms and concepts to understand so you can choose the right Investment Platform based in the UK, who you will use to actually invest your money with and money will be saved with.

** DISCLAIMER – my blog and youtube channel are for information purposes only, and do not act as financial advice for every individual. Before changing any financial habit or investing, please ensure you are completely comfortable with your choices – it’s YOUR MONEY after all!

Creating a Passive income will may require some time and effort initially to set up the process, but often the small amount of time to create or start the income is a one-time effort with minimal maintenance required long term.

Most of the world lives with the mindset that you must work in order to produce an income, and with a limited amount of time each day to do that – our total possible income is fixed.

Without any more hours in the day, you simply cannot make any more money!

I want us to be smarter than the norm and by creating multiple sources of income in general allow us to become less reliant on our main income source (our job and career usually) and diversify taking away alot of potential pain and risk from unemployment in the future.

It goes without saying but on my blog and Youtube Channel my hope and passion is that everyone understands how easy and simple it is to start investing in the Stocks and Shares market in a tax efficient way to gain passive income every month.

This is one of the basic principles that I believe everyone can apply, even if you only choose this as your only form of Passive income outside of your job, and really requires little to no input of your time once you have a plan set up.

Investing in a low-cost index or mutual funds allows you to own a part of many hundreds of generally the top performing companies in the world and then as they use your money to make profits, they return back some of those profits to you.

Of course with investments there is a level of risk, however by spending time understanding how to minimise those risks as best as we can – we can ensure that year on year using Investments as part of a income source long term (10+years at least) we will continue to see a higher return for our money deposited.

It works with the power of time and compound interest, our amount total saved in for example an Investment ISA (a tax efficient way to save up to £20k per person per year currently) gains interest in the form of the change in the fund pricing from when we bought it to the current date.

You can find out more about Investing on this blog too, feel free to check out my video below as an intro:

When you are looking to start investing, there are many companies and platforms out there to choose from all with different charges and services.

With any money strategy it is important to understand which one is best for you, and also how to keep as much of your returns in your pocket.

Passive incomes and becoming a form of investor with your resources to create incomes this way are a key component of a well-known Money Principle called the Cash Flow Quadrant.

You can find out more about this strategy in my video below:

What do we need to get started?

In recent years, the rise of Investment ISAs (Individual Savings Accounts) and the appearance of them even in your local Bank or Building Society for normal saving goals has sky-rocketed away from the previous world of needing a Stocks and Shares Broker to carry out the complex “buying and selling” of your desired shares process for you. No more do we need to feel overwhelmed by the process, or feel even that investing is for only the rich and wealthy – nowadays absolutely everyone can and should understand the power of investing and how this can drive your financial freedom quicker than regularly savings alone as part of a money management strategy.

Now all we need is a computer and enough financial knowledge so we understand the basic principles of investing in the stock market to allow us to actively start and successfully invest in companies around the world.

Why does the Investment Platform we choose matter?

It really is all down to allowing you to achieve your financial goals and also keep as much of your own money in your investment pot as possible, rather than be taken away by fees and charges from the investment provider.

Investing in a form of Investment ISA (tax free savings on the increase up to £20k per person per year) makes complete sense if you are looking for a first step into investing without having to pay additoinal capital gains tax on top of your increase every year.

However, it is important to know that as we are working with real companies in all aspects of this process, giving our money and purchasing stocks, that there will be charges involved. Our job is to keep those charges to a minimum based on our requirements for the money overall.

What are the main types of charges to look for?

You will often see listed with any Investment Platform two types of charges – Admin fees and Fund/Dealing fees.

Admin fees are exactly as they sound – they are usually a monthly or yearly fee applied to your overall investment pot of money held and taken by the investment company in order to “maintain” your account with them.

Generally this should be as low as possible such as between 0.1-0.5% of your total investment pot held yearly charge. You might find that this charge is broken down into quarterly or monthly accordingly and obviously will be based purely on the total amount you hold invested, not just the amount you purchased in that time period.

Some investment companies may charge you a flat fee instead of a percentage for your admin charge, so make sure that whatever provider you go with offers you the best deal for the amount you wish to invest every year by working out the exact amount you are likely to be paying for charges.

The Fund/Dealing fees relate to the individual funds/ETFs/Bonds/Mutual funds we purchase with our money and will vary depending on what we choose to purchase.

Ideally we would be looking to invest in as low a cost fund as possible, such as Index funds as these require no human action in order to complete the transaction compared with Actively managed Mutual funds where charges will be higher as a Fund manager is actively managing and selecting the blend of funds and mix for you.

It is not uncommon to find index funds with low charges such as 0.06-0.22% and even some offer free buying and selling options.

If you are looking to actively buy and sell as part of your investment strategy, then it is important to notice if a flat fee for dealing works out better for you than a percentage charge – as over time this could add up considerably.

What to consider when selecting a Platform

- Charges – the cheapest fees in terms of % or flat fee do not always mean it is the best choice for you. Decide on what kind of investments you will be making every month or year and work out which option will work out the cheapest for you. This will largely be determined by whether you plan to purchase funds, ETFs, Bonds or individual company stocks.

- Know your goal for the investment – if your goal is long term income from the dividends/change in fund prices then look for a platform that allows regularly deposits without large fees. Consider even a platform that looks to give you cheaper fees as your money grows over time.

- Platform ease of use and customer experience – a vital component of any service you use, make sure that the platform and company allow you all the information you need to make an informed choice for your investment strategy. Many are completely online based, so be sure that you can get answers to questions and information about your current investments without too much hassle.

- Extra “hidden” charges – check out if there are any dividend reinvestment fees, funds, exit fees and so on associated with your investments. All these charges take away from your investment increases, and very quickly can add up! Be sure to understand everything that potentially could take money away from you when you wish to use your investments as a form of income.

What charges look like across the most popular options

In the UK we have a number of options based on whether you wish to go down the road of an Investment ISA account or General Investment Account.

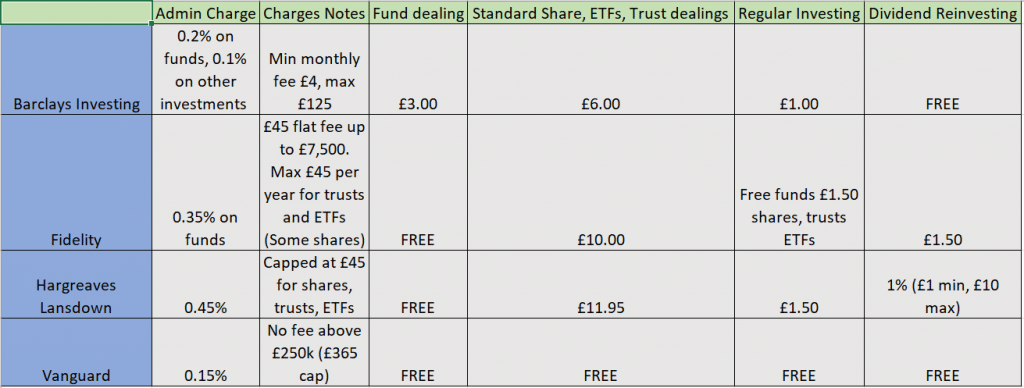

Here are a breakdown of the key companies right now for your consideration:

As you can see, the charges and costs can vary quite dramatically depending on who you select for your investments.

I personally use Vanguard and their Investment ISA as my savings option for financial freedom right now, but of course like any investment strategy be sure to research as much as you can about the funds/shares you wish to purchase and the costs involved overall.

With my Tried and Tested Principles, we can change your financial life around completely in just 1 week.