**Capital at risk with pensions**

**Capital at risk with pensions**

Pensions in the UK seem to be the one topic that you either are passionate about, or pretend to ignore and put your head in the sand believing that the “Government State Pension” will allow you to live life comfortable in those far away years to come.

One of my missions for this blog and my work is to help others create total financial freedom and security on their own, without relying on contributions from other sources, so that we can ensure that FEARLESS knowledge and mindset that we have everything as secure as we can make it should life change or we want to create it slightly differently.

That means we learn how to effectively use money as a tool to create wealth sooner than we think, and dare I say it – even retire from our day jobs if we create a plan and keep committed to the process whilst also allowing for life to naturally take its course.

** DISCLAIMER – any advice on my blog or youtube channel is for information purposes only and is not to be taken as financial advice for your situation. My advice is based on my own knowledge, understanding, goals and preferences for risk and therefore not unique to every individual. If you seek to invest in a pension or investments in general, please ensure you understand that investments can go up and down and therefore there are no guaranteed outcomes for your money. If in any doubt, before making any financial decisions for your future, seek out a financial adviser. My hope is that you can learn the tools and skills so you are confident in your choices too. **

How do Pensions work?

If you are unsure about Pensions and what they are, I recommend you check out my latest blog post and video to get familiar with the general terms and reasons why a Pension should part of your financial future strategy.

If you are Self-employed or already have a workplace pension you are automatically enrolled in, remember you can also have a Private pension and receive the same tax efficiencies up to the total of £40k invested per person per year over all your pensions.

In this post, I will be showing you step by step how to set up your own Private Pension using PensionBee.

This is NOT A SPONSORED POST OR ADVERT

I just really like their product and services mainly as they allow you to transfer existing pensions to them quickly and easily; allow you to see your pension pot with immediate access via their app and overall believe that everyone should have a pension that is easy to understand for their future.

When should you set up a pension and pay into it?

Start as early as you can!

If you take one piece of advice from this, it is all about the magic of compound interest and why small amounts over a long period of time allow you to grow your wealth for your retirement exponentially.

I use a Pension contribution as part of my pre-tax financial plan where my employer makes contributions and I also make a salary sacrifice every month from my top line earnings (before tax is taking from the amount earned).

The other part of my future planning for our earlier than normal retirement and financial freedom is using Investment ISAs (using our money to invest in the stock market for higher than normal returns using index & mutual funds) and you can find out more about why I love investing in these articles:

Opening an Investment ISA with Vanguard (Step by Step Tutorial)

Who can open a Private Pension?

If you’re self–employed, you can set up a personal pension to save for your retirement.

You can add regular contributions or make ad hoc payments into yourself–employed pension, and your pension provider will claim tax relief and add it to your pension pot.

If you are employed as well, you can have your company’s pension plan from your pre-tax wages as normal and then use a Private Pension for further income sources from the age 55 years.

If you are thinking of opening a Private pension and believe it is the right decision for you and your financial path ahead, you will receive £50 as a thank you from PensionBee using the below URL:

https://www.pensionbee.com/mamafurfur

(Capital at risk)

What are the benefits of a Private Pension?

One of the most obvious is really that you will have access to more diversified investment options for your money compared to regular banking accounts or workplace pensions.

Generally a workplace pension will have very few choices for your investments, due to the company selected to provide the service for the many employees as a whole.

With a private pension however that you set up yourself, you can hand-pick exactly what you wish to invest in and how you wish to diversify that selection with payments and funds.

You will receive tax relief on any amounts placed into your pension up to the personal yearly limit (monthly or ad-hoc) and will allow you to have greater control on how your money is invested and the risk level of that investment/possible return on your money.

With any investments though, there is a risk that your money will be worth less than you place into it – but generally we can assume that a return of 3-5% year on year growth is likely with our investments.

Should you die before you reach 75 years old, the pension pot is then given to your dependents as a tax free amount OR the pension can be paid as an income to the nominated reciprocate.

Before making your final choice for a Private pension, I recommend checking out this great post on Money.co.uk with the top UK Private pension options.

Calculate how much of a Pension Pot you need

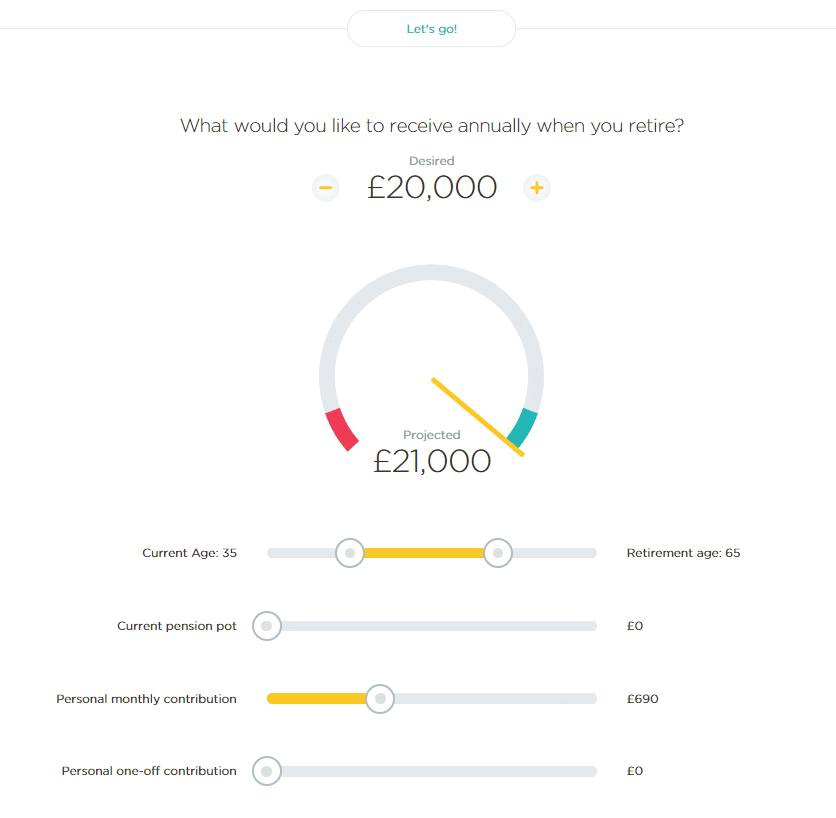

I really loved playing around with the Pension Calculator tool in particular on the PensionBee site and you can find it here.

For example, if we took the UK average of £29k wage and assumed that a person would roughly need a pension income of £20k (roughly 2/3 of their working wage) to pay for living expenses and enjoy life (assuming no mortgage or children to care for by the age of 65 years ideally) it worked out for me that I would need to invest in my pension around £690 a month from ages 35 to 65 years without fail.

That equals to roughly 29% of my take home pre-tax wage every month alone!

An amount by no means common-place with most mid-thirty year olds I’m sure, and staggering to think that most of us really are not set for the income we probably need or wish in retirement.

The time to act for our financial future is now!

I found there tool to show the average pension for your local area really fascinating too – for example in Scotland where I live the average pension income is £12k with only 32% of the working population making regular contributions!

That is shocking to see that over two thirds of working age are relying on the State Pension of currently around £550 a month to live on as their source of income in the future!

Know your Pension charges and fees

Before we get started on setting up a pension, whenever you are researching this critical area of your financial journey and future – be sure to look at the fine print on the pension charges and fees.

With ANY type of investment, you will pay the provider, insurance company or bank a fee for them setting up your investment with them and for them to keep it for you.

I like PensionBee as they have ONE total fee for using their services completely, whereas some companies can charge you set-up fees (moving your pension to them), holding fees, inactivity fees (if you stop making contributions at any point before retirement), exit fees and the list goes on and on.

The lower the fees and charges can literally keep you THOUSANDS and YEARS OF INCOME in your pocket.

For example, if you are making 5% return on your pension pot every year, but the investment firm is charging you 2% fee to manage this for you – then guess what, you only actually receive around 3% rate of return and effectively losing nearly a half of your potential profits.

Keep that repeating year and year as the pot of money grows and this could mean your pot and income is dramatically reduce due to that one charge taken from you.

With PensionBee, you pay between 0.50% and 0.95% depending on the plan you choose, which we’ll automatically deduct from your pension pot.

If your pot size is larger than £100,000 we’ll halve the fee on the portion of your savings over this amount.

For me those levels of fees are suitable for our return potentials and future income, and a reason why I decided to go with them for our private pensions currently.

How to set up a Private Pension (Step by Step)

In this video, I am going to talk you through how we used PensionBee to find previous employer pensions to be combined in one place for a new Private Pension, and then how to set up a plan and payments.

It really is very straight forward, and for me is one of the simplest ways to get the benefits of tax relief and diversification on our future planning for the age of 55 years and over.

As with any investment and your financial future, if you are unable in any way of what to invest in with your money – please feel free to contact a Financial Adviser to talk you through your full options to match your lifestyle and goals.

This blog and youtube post is meant only for information purposes only based on what my family has chosen, and one size doesn’t fit all!

Not enough money left over each month or barely enough to last you post the few few weeks?

With my Tried and Tested Principles, we can change your financial life around completely in just 1 week.