Do you dread Monday morning and facing the normal 9-5 working day again?

Long to be completely free from having to work from a living, but don’t know where to start?

Well you are in luck!

This blog is dedicated to helping you set financial goals and know exactly what you need to do to achieve total financial freedom and security, and even one day allowing you to retire from the rat race completely and do whatever you truly love whilst living off your finances happily for the rest of your life.

This isn’t a pipe line dream – this can be a reality.

And a reality with a little focus and dedication.

Knowing exactly what you are working towards is key – so here are the 5 financial numbers you need to know to make financial freedom your future too.

// The 10% Rule #GAMECHANGER

The key to financial freedom really is having as little costs as you can that you require money for, and aiming to own as much essential living items too.

Think of important daily items such as your house, food, electricity and your method of transport.

Outside of this though, how much would you really need if you were to live completely free from having to work?

I will let you decide the lifestyle though you want to aim for, but one rule will help you get there.

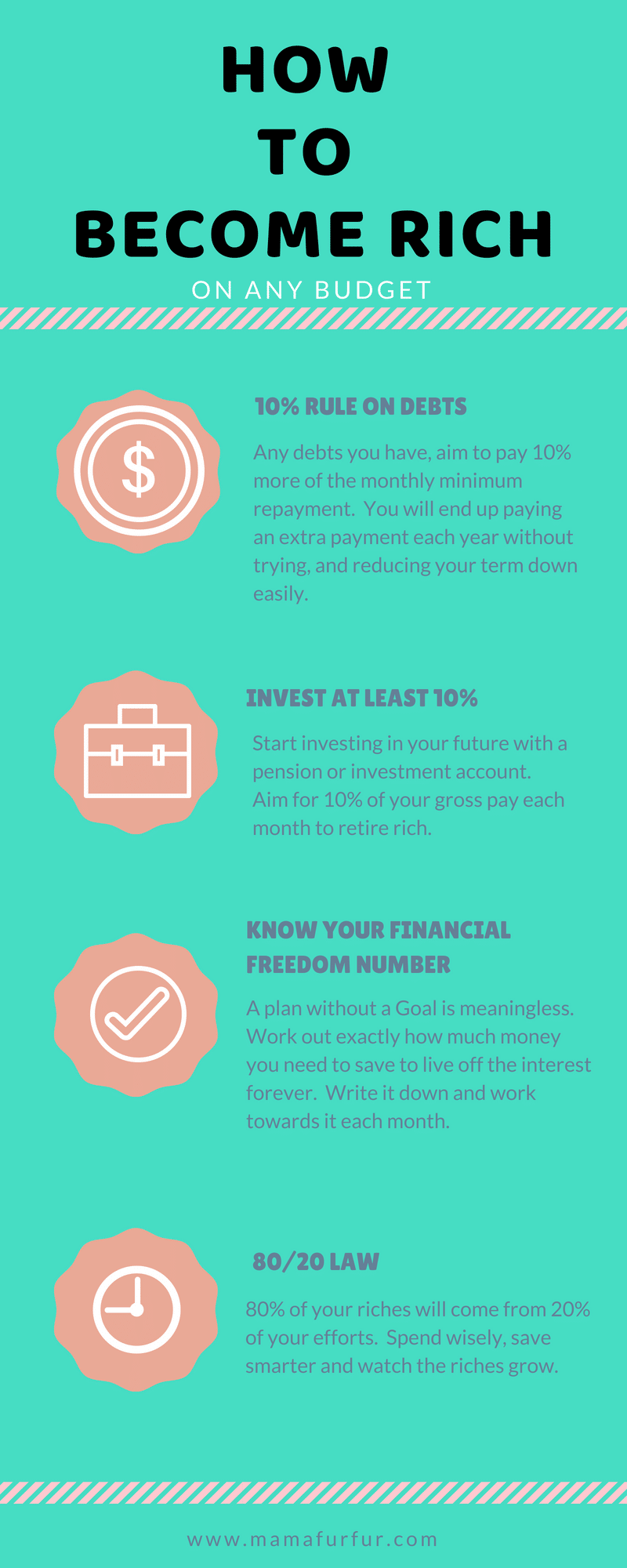

The 10% Rule

With any monthly repayment, whether it be credit card debt, a mortgage, a car payment – the 10% rule can save you serious money and get you to your goals quickly.

The 10% rule is simply committing to paying an extra 10% on top of your normal monthly payment each month by direct debit and thinking nothing more of it.

In reality 10% more is usually quite small and possible, but here is where the magic happens.

You end up making one extra whole payment a year (plus some more) without you even noticing it.

And with that extra payment a year, you will usually save considerable interest back into your pocket to use for more exciting and fun activities instead.

For example, on a £5000 loan at 4.5% interest you would normally pay £100 a month for repayment for 5 years.

If you choose to pay back £110 instead (10% more each month) you will pay off your loan 6 months early without really trying or suffering.

That means £660 back in your pocket to use to put towards your next holiday, or even invest and start your emergency fund.

Get paid every 4 weeks instead of monthly?

Even easier to apply the 10% rule – simply half of your mortgage or credit card payment every 2 weeks instead of once a month.

You will then make an extra payment just the same as if you were adding on 10% each month, and it even makes your budget easier by managing every 4 weeks rather than calendar month and balancing books.

Remember the key is to set everything on AutoPilot – make all payments and extra payments on direct debit or standing order with your bank so you don’t have to physically do anything to make it all happen.

Anything on automatic will work – anything you rely on yourself to manually do will more likely fail to happen.

// Aim for 10-25% of your PRE-Tax Wage in investments and retirement

Start by saving even just 1% of your Pre-tax (the amount before you pay the tax man and national insurance, so you very top line when you say how much you earn each year) in a Pension fund provided by your employer or in your own Pension or Investment ISA & Fund.

But set yourself a goal to make that percentage as high as possible.

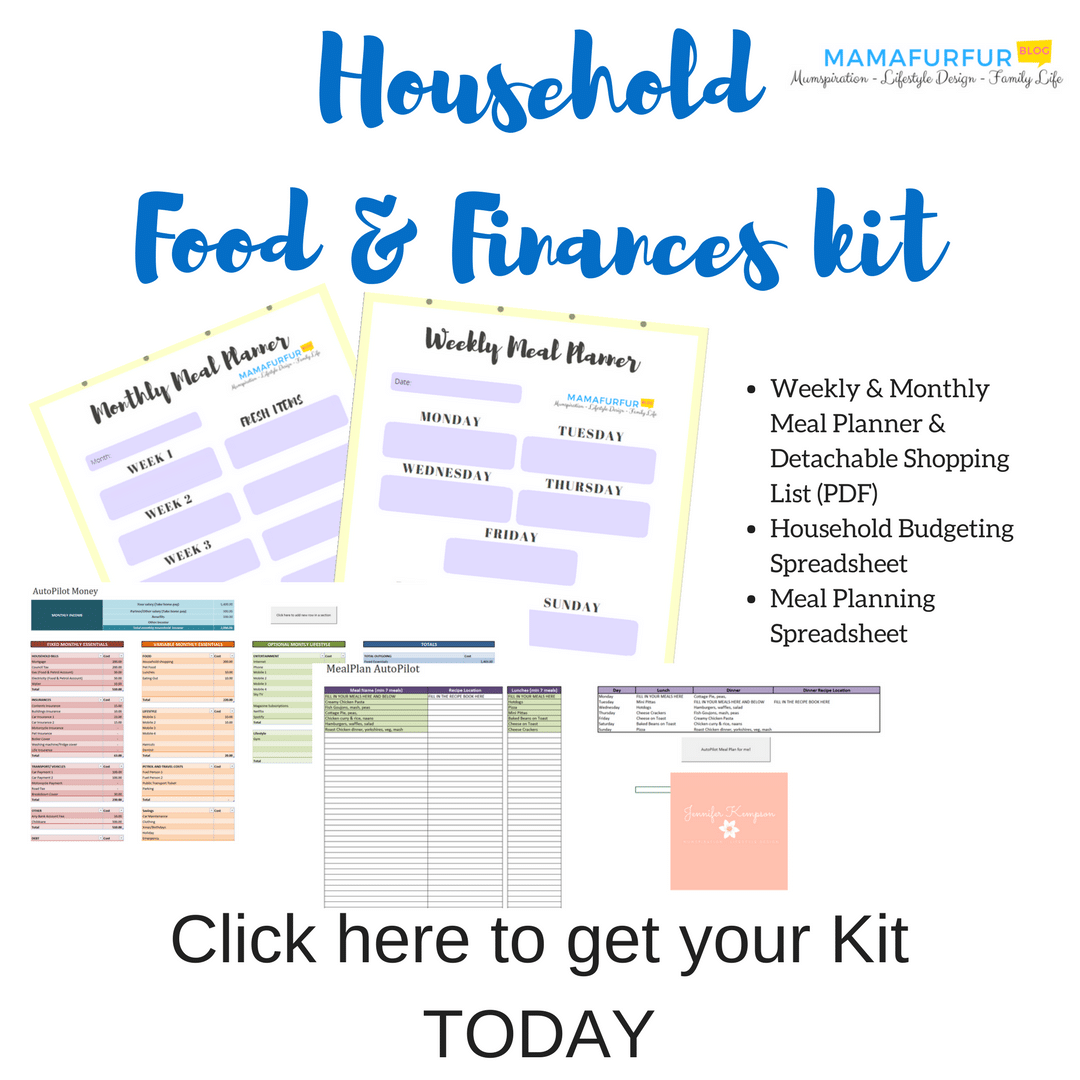

Use my AutoPilot Money Spreadsheet to see the percentages you are saving too on my Etsy store here.

By paying your future self first each and every month, and by taking it straight from your wage without you realising, you are making your future self rich.

A lot of people are scared to invest, using the power of compound interest to make their money grow, but it is straight forward and everyone should do it.

Want to start? Look at this post here.

You can even follow Look at this post here on this blog and my youtube channel.

If you earn for example £25k yearly pre-tax, if you place 10% (£210 each month) into a pension or investment fund with an average rate of return of 5% and you started at age 25 you would have roughly £322k in savings by retirement age of 65 years.

The interest alone then each year for the rest of your life would be roughly £16k and you would be financial free.

That doesn’t include then the State pension on top you would receive.

Start at the age of 35, same amount each month invested and you would have roughly £176k in savings and receive nearly £9k a year in profits from the interest to live off, then a state pension to follow at age 65 roughly on top.

Let’s say though you pushed yourself towards 20% (£410) of your pre-tax wage in investments or pensions.

Age 25, you would then be able to retire at age 55 (10 years earlier) with savings of £351k roughly.

Age 35 – you would be able to retire at age 55 (10 years earlier) with savings of £174k roughly.

The important thing to remember is when you pay into a pension scheme as pre-tax where the money is taken straight from your wage each month before tax is applied, the physical money you would have received into your pocket instead is about 30% less.

Place £200 into your pension, you are only missing out on roughly £160 in your pocket.

Pre-tax money is worth more and will make you richer without you releasing or feeling the loss as much.

Even better – whenever your employer makes contributions to your pensions on top of your donations, JUMP ALL OVER IT!

IT’S FREE MONEY – they are effectively giving you extra money to your wage and future wage by placing more money not from your wage into your pension bucket.

Make the change to start paying into your future self pension and investments even just 1% and challenge yourself to increase it as quickly as you can afford with the goal of 20% or more ultimately.

Do this and you will surely be financial free quicker and retire earlier than the rest.

// Know your Financial Freedom Exact Amount Number Goal

Do you know exactly how much money you need in savings or investments to live off the profits for the rest of your life?

To have the compound interest on that amount give you your living wage each year and never have to dip into reducing the savings amount?

Using the power of compound interest and investments that return better than normal bank rates, investing in the Stock market with Investment ISAs for example, you can do this.

Having a goal to be financial free is one thing, but in order to make it a reality and work towards it each month you need to know the exact amount.

You can work it out roughly by saying 25 times x your yearly salary to keep your house and living expenses.

I would urge you to use the amount that truly would be the essentials if you didn’t need to work but enjoy your days instead (no extra coffees each day if you could afford it) as a starter goal.

You can use my post and video here that shows you exactly how long it will take you to reach that goal and then write it down.

Set yourself a yearly goal to work towards it in yearly increments, depending on the year you wish to retire by and even work out how quickly you can hit the goal if you really put your efforts to it.

I know my number exactly and know how far along the road we are right now to hitting it.

Do the same for yourself and have that ultimate goal in mind.

// Pareto Law – 80/20 rule – Law of the Vital Few

The 80/20 rule is everywhere you look and the first thing mentioned usually whenever you are looking at focusing your efforts truly where they add value and joy in your life.

For your financial freedom and security, try to aim for your monthly budget amounts to be 80% spending on living life to its fullest as you can right now and 20% of your money is invested in passive and active incomes.

Aim for around 50% of your total monthly budget on your household essentials where possible and the rest of the 30% for your spending money to be on fun and the extras such as holidays and luxuries.

You can find out the exact percentages I have currently in my family’s budget right now here.

If you know these numbers you are sure to be on the right path to financial freedom and security.