We all LOVE the idea of not having to do a normal 9-5 day job, to be at home with the children, to work on that project that really excites you – but how do you aim for that whilst normal life will need to resume right now?

In this video I show you exactly how to work out your Savings/Financial Freedom Goal Value using your budgeting spreadsheet values and a Compound Interest calculator tool.

This gives you a way to show roughly how long saving as you currently do, it would take you to not rely on a job for income but with your savings generate that money instead – or if you were able to save harder, when would you reach that amount too.

Let it inspire you on your journey.

// Step 1 – We need to know how much money is required each month to live the life we currently have or believe we can maintain in the future.

You are going to need to have a budget created before you can do anything, and we are interested in the amount of money required for us to pay the essential life bills (Rent/Mortgage, Electricity, Food, Transport) and some basics. This is just a starting point and we can make life more elaborate once we have a first attempt goal value to aim for.

On a spreadsheet (In the video I recommend my AutoPilot Money Spreadsheet available from my Etsy Store that I use personally with my family and my financial goals) is the ideal place to have this information stored, as you can do the necessarily calculations quickly and easily.

Total up the exact amount of money you need to have your home right now and pay the essential bills.

Write that amount down and it could be for example £1400 per month.

–> DOWNLOAD YOUR OWN MONEY MANAGEMENT SPREADSHEET HERE –<

// Step 2 – Multiple your monthly total expenses to give your Yearly Expense amount, then times by 25

Simple step – multiple that amount by 12 to give your Yearly Expenses amount total. This is the value we need to remember, so for practice sake let’s assume it could be £1400 x 12 = £16,800.

Multiple it by 25 (to give us roughly Compound Interest of 4% return on that total large amount) for example £16800 x 25 = £420,000.

That Value is your EXACT Financial Freedom Amount you need to raise to then live off happily the interest each year.

// Step 3 – Understand that you need to create money from your money

WE NEED COMPOUND INTEREST to create that interest to live off from our Financial Freedom Total Amount.

You need to create money from the money that you plan to save towards this goal. You either need to be a Business Owner, where profits come without you giving up all your time to run it, or you are investing some part of your money.

Right now in the UK, the interest rates on normal Savings accounts are too low to matter – around 0.05% – so we need to consider Investing some part of our money to work towards this Financial Freedom Goal.

With my family, I use a Stocks and Shares ISA for my Savings (return around 3-6% based on Hedge fund selected) and also we MAX OUT our Employee Pensions.

Pensions are savings you can put money into whilst working BEFORE TAX therefore effectively losing you less of your “Take Home Pay” in each pay check. Some companies also give you matched contributions – such as they will put 4% into your pension when you donate 4% too – TAKE THAT MONEY AND RUN!

It is FREE MONEY and you should be all over it like a rash whilst you work for an employee that offers you any matched or partial contributions. Some companies even offer you double contributions – so 4% you put in, they put in an additional 8% for example.

We want to make savings in as many places that offer good compound interest rates, with as much risk as you are willing to take.

**Please note my recommendations are based on my risk level and are not meant as financial absolute advice. Please be sure to read up on your pension and savings options before you invest your own money in them.**

Step 4 – Use a Compound Interest Calculator tool to see how long it will take you to reach your Goal amount with your current savings pattern, then play around with it.

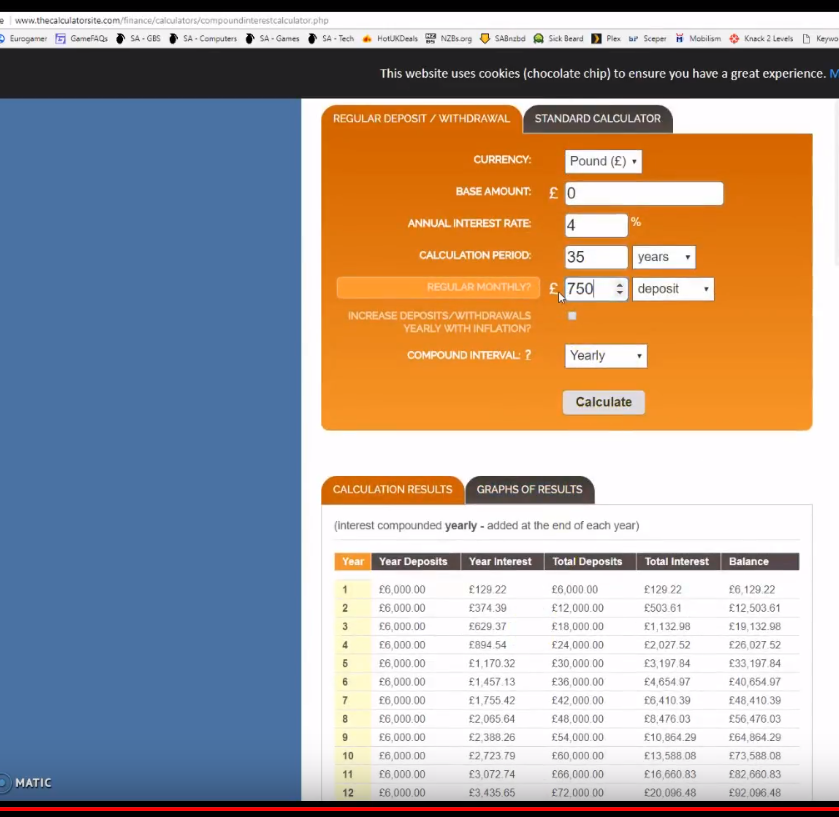

On the video you will see that I use a simply Compound Interest Calculator tool at The Calculator Site to work out how long it will take me, using my current monthly Saving amount, to reach that Goal Value.

This is where the fun starts.

Based on your current savings pattern, it could take quite a while. Or it could take less time than you thought.

We are looking for the year where the “Yearly Interest” generated on our Total Balance amount equals that Yearly Expenses Total for our household we talked about before.

Don’t like the time you see? How can you improve it?

- Increase your monthly savings contributions – remember to make the monthly contribution equal to your pension contributions and savings amount combined.

- After all, you are saving in multiple places hopefully towards this goal.

- Look over your Expenses and see if you really could reduce them or cut them back, if you could live a life completely free from work forever.

- That tends to make the Cable TV bill not so appealing to pay if you really wanted to be financial free as quickly as possible.

- Look into investing in higher risk places – get more Compound Interest on your money, the quicker you get there!

The most important thing to remember is any money you are savings towards your Financial Freedom Future, you must be committed to leaving it there for at least 5-10 years for the power of compound Interest and Time to work it’s magic.

To make you feel more secure you might want to have a separate Emergency Money Fund set up with quick access to a month’s household expenses there – but that is up to you.

We don’t want to touch our financial freedom money if we can, as this puts us a step backwards rather than forwards.

// Step 5 – Commit to making those savings and keep at it. Don’t lose the Faith!

People often see a large financial value or a number of years of effort as too much like hard work. You are going to wish you started a year from now, so start today and make up for lost time.

Everything worth having takes time, and you will be proud to know you are putting money back into your pocket each and every year now by Smarter Money Management.

Over the next few months on this Blog and Vlog Channel, I will continue to share with you our family’s journey on this Financial Freedom Path and I’m excited for what it will bring.

Be sure to start your own Journey Today too!

2 thoughts on “How to Calculate Your FINANCIAL FREEDOM Exact Number”

This I need to look at more in the new year. Great post and a great resource xx